Understanding the economics of affordable housing development is essential in areas like British Columbia (BC), where housing costs can be exorbitant. Affordable housing is a vital issue on a worldwide scale. This blog examines the expenses, funding sources, and different financial models that assist in the development of affordable housing in British Columbia.

Understanding Affordable Housing Costs

Developing affordable housing involves several cost components, including:

- Land Acquisition: Land suitable for home construction varies greatly in price throughout British Columbia, with metropolitan areas typically fetching higher costs.

- Construction Costs: Construction costs are influenced by labor costs, material costs, and regulatory constraints. Cost-cutting measures are frequently taken in affordable housing projects without sacrificing quality.

- Development Fees and Permits: The upfront expenses of development are increased by fees for construction permits, zoning amendments, and other regulatory procedures.

- Infrastructure and Utilities: Significant expenses are also incurred while connecting the dwelling units to utilities including electricity, water, sewage, and roads.

- Operating and Maintenance Costs: Budgeting is necessary for continuing operating costs like property management and upkeep after construction is complete.

Sources of Funding for Affordable Housing

To address the high costs associated with affordable housing development, various funding sources are leveraged:

- Government Subsidies and Grants: The federal, provincial, and local governments fund affordable housing projects with grants, subsidies, and tax breaks. These grants aid in closing the affordability gap between development expenses and rental or purchase prices.

- Low-Income Housing Tax Credits (LIHTC): Tax incentives are offered by LIHTC programs in Canada to developers who construct or renovate affordable rental housing. Affordable housing projects benefit from private investment brought in by these credits.

- Public-Private Partnerships (PPPs): Government agencies and private developers working together can combine public subsidies with capital and knowledge from the private sector. PPPs aid in risk distribution and effective use of both public and private resources.

- Nonprofit Organizations and Charitable Donations: Due to their ability to use donations, endowments, and fundraising efforts to subsidize housing costs, nonprofits and charitable organizations are essential to the development of affordable housing.

- Community Investment Funds: These funds are used to finance affordable housing projects that directly benefit the community by pooling investments from local businesses, organizations, and community members.

Financial Models for Affordable Housing Development

Several financial models are employed to make affordable housing projects financially viable:

- Income-Based Rent: Tenant income levels are taken into account when setting rent levels, which guarantees affordability while paying for operating expenses.

- Cross-Subsidization: In mixed-income developments, the overall project’s financial sustainability is achieved through the subordination of lower rents in affordable units to higher rents from market-rate units.

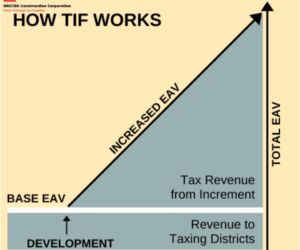

- Tax Increment Financing (TIF): TIF reserves the right to use future increases in property tax income brought in by the development to pay for subsidized affordable housing or infrastructure upgrades.

- Impact Investment: Capital for affordable housing projects is provided by investors seeking both financial return and social impact, frequently through structured financing agreements.

- Modular and Prefabricated Construction: By using these techniques, building costs and schedules can be shortened, increasing the possibility of affordable housing.

Challenges and Considerations

Developing affordable housing in BC faces several challenges:

- Regulatory Hurdles: Complying with environmental regulations, building codes, and zoning laws can increase project duration and expense.

- Land Availability: Securing affordable land in prime locations at reasonable prices is frequently a challenge.

- Community Opposition: Some localities resist the construction of affordable housing projects because they are worried about the effects, density, or property values.

- Sustainability: It becomes more complicated to strike a balance between affordability, energy efficiency, and sustainable building methods.

Conclusion

In order to develop affordable housing in British Columbia, a diversified strategy addressing high costs through creative funding sources and financial models is needed. Through the use of community partnerships, private investments, and government subsidies, stakeholders can build inclusive, sustainable communities that provide housing for people of all income levels. To effectively work together to address this urgent societal need, policymakers, developers, and communities must have a solid understanding of the economics underlying affordable housing.